Understanding Sample Bank Statement PDFs

Sample bank statement PDFs provide a record of financial transactions. They’re useful for budgeting, loan applications, and software testing. Understanding their format is crucial for accurate financial record-keeping and analysis. Access to these samples aids in financial literacy.

What is a Bank Statement?

A bank statement is a crucial financial document summarizing all transactions within a specific account over a defined period. It details deposits, withdrawals, and any fees or charges, providing a comprehensive overview of account activity. These statements are typically issued periodically, often monthly, by financial institutions. They serve as a vital record for tracking personal or business finances, ensuring accuracy, and detecting any unauthorized activity. The information presented includes the account holder’s details, account number, transaction dates, descriptions, amounts, and beginning and ending balances. Bank statements are essential for various purposes, including budgeting, reconciling accounts, and providing proof of financial activity for loan applications or other official purposes. Access to accurate and readily available bank statements is crucial for effective financial management.

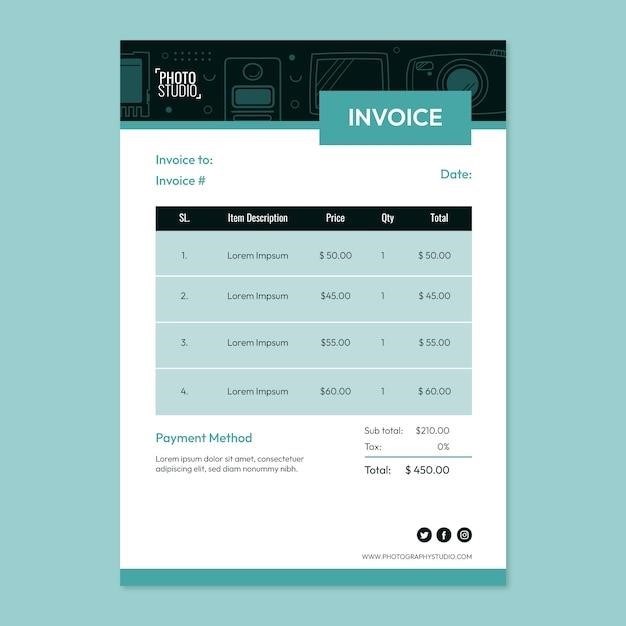

Key Elements of a Bank Statement

A standard bank statement typically includes several key components. Firstly, it displays the account holder’s name and account number for clear identification. The statement clearly indicates the reporting period, specifying the start and end dates covered. A detailed transaction log follows, listing each deposit and withdrawal with corresponding dates, descriptions, and amounts. Running balances are usually shown after each transaction, allowing for easy monitoring of account funds. Furthermore, bank statements often include information on fees or charges incurred during the period. The statement concludes with the opening and closing balances, summarizing the account’s financial status at the beginning and end of the reporting period; The inclusion of the bank’s logo and contact information ensures authenticity and provides a means of inquiry if needed. This comprehensive structure ensures clarity and easy comprehension of the account’s financial activity.

Types of Bank Statements

Bank statements can vary in format and content depending on the issuing institution and the account type. Common types include regular monthly statements, which summarize transactions over a 30-day period. Some banks offer quarterly or annual statements, consolidating transactions over longer intervals. Electronic statements, delivered via online banking portals or email, are increasingly common, offering convenient access and reduced paper consumption. Physical copies, mailed to account holders, remain available for those who prefer a tangible record. Specialized statements might exist for business accounts or specific financial products, providing more detailed information or tailored reporting. The availability of different statement types allows customers to choose the format and frequency that best suits their needs and preferences for managing their finances. The choice influences how readily accessible the financial information is.

Accessing Your Bank Statement

Access your bank statement conveniently through online banking portals, mobile apps, or by requesting a physical copy from your bank. Many banks offer digital downloads for easy access and storage.

Online Banking Portals

Most banks provide secure online banking portals where you can access your statements. After logging in with your credentials, navigate to the “Statements,” “Accounts,” or a similarly labeled section. The interface may vary slightly depending on your bank, but the process is generally straightforward. You’ll typically find options to view your statements online, download them as PDFs, or even set up email delivery of your statements. This eliminates the need for paper copies and offers convenient access from any device with internet connectivity. Look for a date range selector to specify the period you want to review. Once you’ve chosen the desired statement, you can download it to your computer or print a hard copy if necessary. Remember to always use secure internet connections when accessing your bank accounts online. Many banks also provide security features like multi-factor authentication to protect your account information. Always ensure the website you are using is legitimate and secure before entering any personal or financial details.

Mobile Banking Apps

Many banks offer mobile banking apps for smartphones and tablets, providing convenient access to your bank statements. These apps typically mirror the functionality of online banking portals, allowing you to view, download, and manage your statements directly from your mobile device. The user interface is usually designed for ease of navigation on smaller screens. After logging in, find the section dedicated to statements or account history. You can usually select the period you wish to view and download the statement as a PDF. Some apps may even allow you to set up notifications for when new statements are available. This mobile accessibility makes checking your statements incredibly convenient, regardless of your location. Remember to download the official app from reputable app stores to ensure security and avoid malicious software. Always protect your mobile device with a strong password or biometric authentication for added security.

Requesting a Physical Copy

While online access is prevalent, you can still request a physical copy of your bank statement. Contact your bank’s customer service department—either by phone, mail, or through their website’s contact form—to initiate the request. You’ll likely need to provide identifying information to verify your account ownership. Specify the period for which you need the statement; some banks may have limitations on the timeframe. There might be a fee associated with this service, depending on your bank’s policies. The physical copy will be mailed to your registered address on file with the bank. Allow sufficient processing and mailing time; this method is generally slower than accessing statements electronically. Keep in mind that requesting a physical copy contributes to paper consumption and slower processing times compared to digital options. Consider environmental impact and efficiency before requesting a physical copy.

Creating Your Own Bank Statement

Creating realistic-looking bank statements can be achieved using templates, specialized generators, or dedicated software. These tools offer customizable features for various needs, from personal budgeting to software testing.

Using Templates

Numerous free and paid bank statement templates are available online and from various sources. These templates provide a pre-formatted structure, saving you time and effort in creating your own statement. Many offer customizable fields for personal details, account information, transaction entries, and balances. Templates often come in various formats like PDF, Word, or other editable file types. Choosing a template allows for quick generation of a professional-looking document, ideal for personal use, practice, or educational purposes. Remember to select a template that aligns with the specific requirements and regulations of your region or intended use. Carefully review and fill in all necessary details accurately to ensure the document’s authenticity and validity. Incorrect information can lead to complications, especially when using the document for official purposes, such as loan applications or proof of address.

Bank Statement Generators

Online bank statement generators offer a convenient way to create realistic-looking bank statements without needing design skills or templates. These tools typically allow customization of various details, including account holder information, transaction dates, amounts, descriptions, and balances. Some generators even offer options to simulate different bank formats or styles. The generated statements can be saved in various formats like PDF for easy sharing or printing. While useful for practice, education, or software testing, it’s crucial to remember that these generated statements are not genuine bank documents and should never be used for fraudulent purposes. Using a generator for unauthorized activities is illegal and carries severe consequences. Always ensure responsible and ethical use of these tools and clearly identify any generated statements as such to avoid any misunderstandings or misrepresentations.

Software for Generating Bank Statements

Specialized software applications provide comprehensive features for generating bank statements, often exceeding the capabilities of online generators. These programs may integrate with accounting software or financial management systems, streamlining data entry and report creation. Advanced features could include automated transaction import, custom report templates, and enhanced security measures to protect sensitive financial data. Such software is commonly used by financial institutions, businesses, and accounting professionals requiring high-volume statement generation or complex reporting functionalities. The software often offers various export options, including PDF, for easy distribution and archiving. The choice of software depends on specific needs and budget, with options ranging from free, open-source tools to expensive, sophisticated packages.

Uses of Sample Bank Statements

Sample bank statements are valuable tools for various purposes, including financial planning, budgeting, and loan applications. They also aid in software testing and educational demonstrations.

Financial Planning and Budgeting

Analyzing sample bank statements helps individuals and businesses understand their spending habits and financial health. By reviewing past transactions, users can identify areas where they can cut back on expenses and create more effective budgets. Sample statements allow for practice in financial planning without risking real account data. This is particularly useful for beginners learning to track income and expenses. The ability to input hypothetical transactions into a sample statement provides a safe environment to experiment with different budgeting strategies and observe their potential outcomes. This hands-on approach enhances understanding of personal finance and improves budgeting skills. Ultimately, using sample bank statements contributes to better financial management and planning.

Proof of Address

A bank statement, especially a sample one for practice purposes, often serves as a reliable proof of address. Many organizations and institutions require verification of residency, and a bank statement, with its clearly printed address, provides this evidence. This is particularly helpful for applications requiring official documentation, such as renting an apartment, obtaining a driver’s license, or applying for a loan. The date and details of transactions further corroborate the address’s authenticity and the applicant’s history at that location. However, it’s crucial to remember that using a sample bank statement for official purposes is generally not accepted; it must be a genuine, official document from a financial institution. Using a sample statement only serves as a way to understand the information required on a legitimate document.

Loan Applications

When applying for a loan, lenders meticulously assess an applicant’s financial stability. A bank statement, whether a sample for practice or a genuine one, plays a pivotal role in this process. Lenders examine the statement to gauge the applicant’s income, spending habits, and overall financial health. Consistent deposits, reasonable spending patterns, and sufficient funds demonstrate financial responsibility. Sample statements can be helpful for understanding the information required by lenders and practicing presenting financial details effectively. However, only official bank statements from established institutions should be submitted as part of a formal loan application. The information presented in the statement should accurately reflect the applicant’s financial reality to ensure a successful application process. Providing false or misleading information is detrimental and can lead to loan denial.

Software Testing

In the realm of software development, particularly for financial applications, sample bank statement PDFs serve as invaluable tools for testing purposes. These sample statements, often created with realistic yet fictitious data, allow developers to rigorously test the functionality of their software without compromising real user data. This includes verifying the accurate processing of deposits, withdrawals, and balance calculations. The testing process ensures the software can correctly interpret the data format, handle various transaction types, and generate accurate reports. Using sample statements helps identify and resolve bugs or inconsistencies before deploying the software to real-world users. This preventative approach safeguards user data and maintains the integrity of the financial system. The use of realistic samples ensures comprehensive testing, mimicking real-world scenarios to achieve a robust and reliable financial application.

Legal and Security Considerations

Protecting sensitive financial data is paramount. Sample bank statements, even if fictional, must adhere to data privacy regulations and prevent fraudulent misuse. Authenticity and compliance are key concerns.

Data Privacy

Handling sample bank statement PDFs necessitates strict adherence to data privacy regulations like GDPR and CCPA. These regulations emphasize the importance of securing personal and financial information. Creating and distributing sample statements requires careful consideration to avoid unauthorized access or disclosure of sensitive data. Anonymization techniques, such as removing personally identifiable information (PII), are crucial. Strong security measures, including encryption and access controls, are essential to protect the confidentiality and integrity of the data. Compliance with relevant privacy laws is not merely a legal requirement but also a crucial aspect of building trust and maintaining ethical standards. Failing to protect sensitive information can lead to severe legal repercussions and reputational damage. Therefore, organizations and individuals handling sample bank statements must prioritize data privacy and implement robust security protocols to safeguard sensitive information.

Authenticity and Fraud Prevention

The authenticity of sample bank statement PDFs is paramount to prevent fraudulent activities. Verifying the source and ensuring the document hasn’t been tampered with is critical. Features like watermarks, unique identifiers, and digital signatures can enhance authenticity. For software testing, using realistic but clearly marked sample statements prevents misuse. Distinguishing genuine statements from fraudulent ones requires careful examination of details such as formatting, logos, and transaction patterns. Inconsistencies or irregularities should raise red flags. Security measures, such as encryption and password protection, should be employed to protect against unauthorized access and modification. Promoting awareness about potential fraud and educating users on how to identify fake bank statements is crucial for protecting individuals and organizations from financial scams. Proper handling and distribution of sample statements contribute significantly to fraud prevention efforts.

Compliance with Regulations

Creating and using sample bank statement PDFs requires strict adherence to data privacy regulations. Compliance with laws like GDPR and CCPA is crucial, especially when dealing with personal financial information. These regulations dictate how data is collected, stored, and used, emphasizing consent and data security. Sample statements should never contain real customer data; using anonymized or fictitious data is essential to avoid legal issues. Organizations providing sample statements must ensure their practices align with relevant banking and financial regulations. Failure to comply can result in significant penalties and legal repercussions. Transparency about data handling practices is important, informing users about how their data is protected and used. Regular audits and updates to security protocols are necessary to maintain compliance with evolving regulations and best practices; The creation and distribution of sample bank statements must always prioritize legal and ethical considerations.

Be First to Comment